A Peak Into Turkey’s Economy: Why Its High GDP Growth Doesn’t Mean a Healthy Economy

- Xiaodan He

- Apr 28, 2023

- 3 min read

Updated: Apr 30, 2023

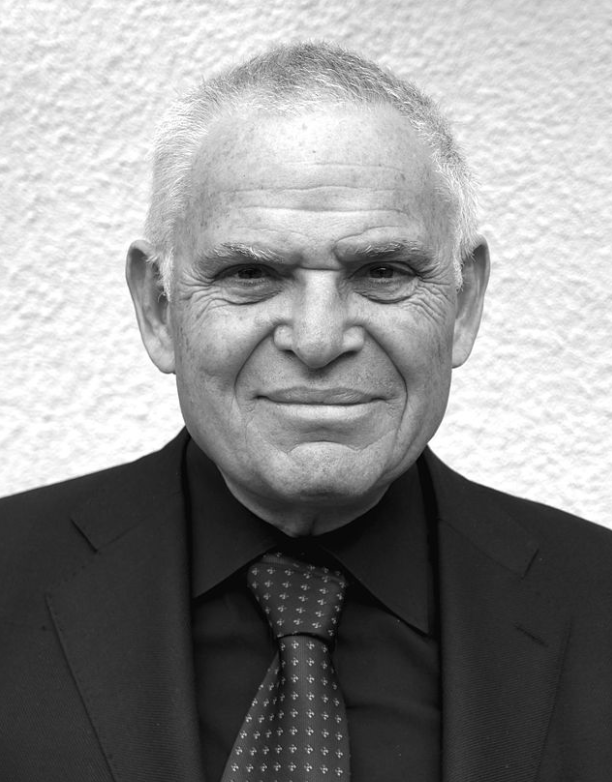

Courtesy of the Wall Street Journal

Turkey’s economy experienced rapid year-over-year growth of 7.5% in the first half of 2022 and is forecasted to continue to grow despite rising inflation and political woes. This growth, however, does not necessarily indicate a healthy economy. Turkish President Recep Tayyip Erdoğan’s unorthodox economic policies under the system of Islamic Finance, which prohibit payments of interest, ignore Turkey’s core economic challenges of high inflation, foreign debt, and capital outflow. The outcomes of Turkey’s economic policies additionally mean that the nation’s foreign relations and domestic human capital retention are being reshaped.

In the mid-20th century, Turkey faced the challenge of catching up with its NATO allies economically. While extensive foreign investments strengthened Turkey’s economy, its drawbacks culminated in high public and personal debt in foreign currency that raised inflation. While Turkey has managed to control its inflation throughout the 2000s by introducing new currencies and raising interest rates, risks of high foreign currency deposits in domestic banks and high current account deficit to GDP still served as inherent threats for high inflation and dollarization. The consequences of this intrinsic threat became evident in 2018 and 2019 when Turkish-American relations deteriorated over Turkey’s relationship with Russia. American President Donald Trump’s tariffs and sanctions on Turkey led to high capital outflow that threatened a financial crisis, given Turkey’s high foreign currency deposits and foreign debt from a high trade deficit.

Erdoğan’s reaction to rising inflation is rather unorthodox to the modern economic theory of combating inflation through raising interest rates. The president instead proposed to decrease interest rates and called it the “father and mother of all evils.” Erdoğan believed that the benefits from increased demand and investments caused by lower interests outweigh its costs. In other words, lower interest rates can stimulate demand and encourage investments that will increase product supply and thus counter rising inflation. The enactment of this ideology resulted in Turkey’s economy today—rapid GDP growth with rapid inflation.

The unorthodox policy around interest rates has traces in Turkey’s Islamic Finance System. The system prohibits receipt and payments of interest and restricts lending and financing unethical activities like alcohol and gambling. Turkey’s Muslim-majority population makes it easier to adopt the system and forms the foundation for economic policies that try to avoid interest rates. Research has shown that such finance systems can encourage economic growth or create significant challenges. Researchers from The ISRA International Journal of Islamic Finance found empirical evidence of the positive impact of Islamic Finance on Turkey’s economy from 2013 to 2019, which continued to be evident until at least 2021. The International Monetary Fund, on the other hand, claims that Islamic Finance, as a niche industry, lacks economies of scale and has unclear legal and tax rules.

The ambiguity around the effectiveness of Islamic Finance is portrayed through Turkey’s tough economy today. The low-interest rates inspired by Islamic Finance and Erdoğan’s policies are forcing Turkish citizens to spend out of fear of rising inflation. Increased investments in stock markets and real estate, in turn raise Turkey’s GDP even under a global economic recession. This increased fear driven spending, however, won’t help Turkey’s economy in the long run unless the problems of inflation, capital outflow, and high trade deficits are accounted for. According to the World Bank, Turkey’s poverty rate is forecasted to remain consistent with pre-2019 levels due to high inflation despite GDP growth. Turkey’s economic challenges are also causing a new wave of brain drain that will threaten its economy even further.

Economic challenges and the global energy crisis are also shaping Turkey’s foreign policy. Erdoğan’s diplomatic ambitions are now focused on establishing and strengthening relations with oil-exporting countries such as Saudi Arabia, Egypt, Qatar, and Russia. Stable relationships with these countries will not only serve future gas import initiatives but also attract the foreign investments that Turkey needs.

As the June presidential elections approach, Erdoğan faces the urgency of repairing Turkey’s economy and international status. The destructive earthquake in February 2023 only harmed the Turkish economy further. The opposition has campaigned on dropping Erdoğan’s economic policies and freeing the central banks to higher interest rates. Erdoğan’s economic policy will most likely continue if he wins the elections.

Turkey’s economy today is a classic example of how religious sentiments impact modern economies. Whether such impacts generate positive economic growth is still to be tested by the Turkish model. If Turkey successfully turns around its economy, this would serve as a counterfactual for theories arguing for the positive relationship between societal secularism and economic development. If Turkey fails to revert its economy, it would suggest otherwise and calls the effectiveness of Islamic Finance into question.

A budgeting talk over coffee with a coworker turned into a deep dive on apps that actually make a difference. Rocket Money came up, and I figured it was worth checking out. Before installing it, I browsed https://rocket-money.pissedconsumer.com/review.html , where real users explained how they used it to track subscriptions and avoid surprise charges. That perspective helped me feel confident trying it out. I’ve already found and canceled a few forgotten auto-renewals, and the weekly spending insights are making it easier to stay ahead without stress.